RAPID RESCORE:

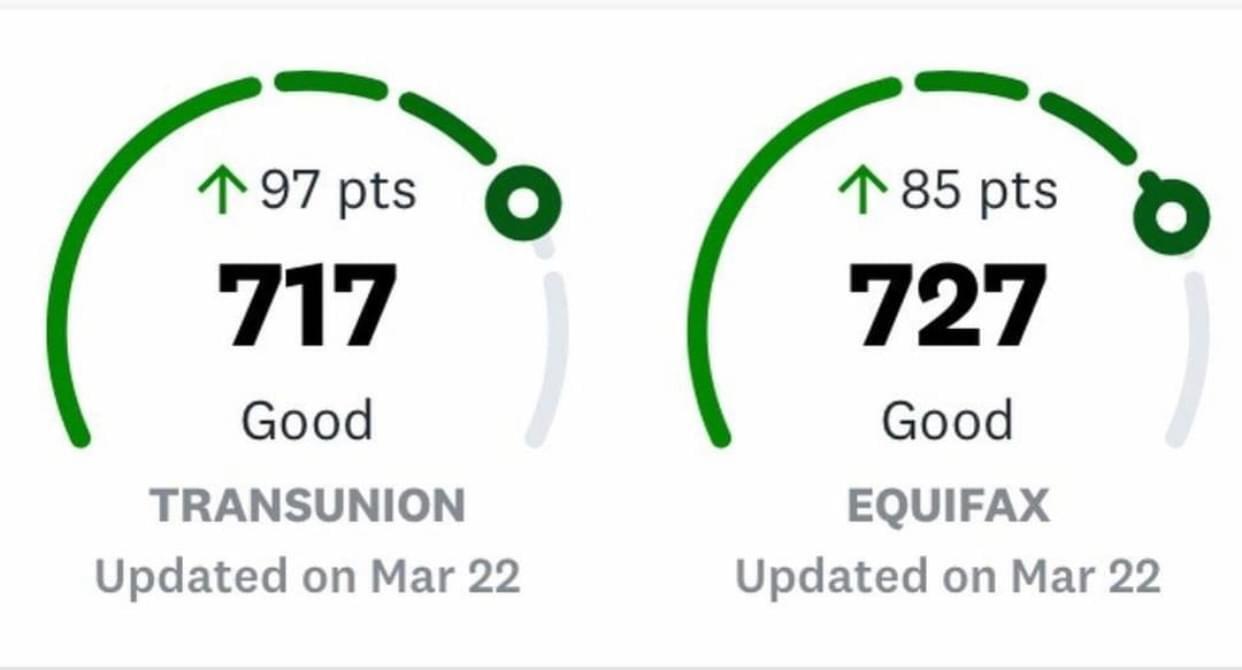

IMPROVE YOUR CREDIT SCORE UP TO 100 POINTS

AS FAST AS 24 HOURS!

(WITHOUT HAVING TO WAIT FOR YOUR CREDITOR)

Correct credit report errors swiftly and secure the best loan rates

Why Your Credit Score Matters

Your credit score is a pivotal factor in loan underwriting. It's crucial that your credit

history and score genuinely mirror your

financial health. But what if there's an

error? Or what if your score is

unexpectedly low?

Introducing Rapid Rescore

What Can You Dispute?

- Derogatory items like missed payments, collections, and public records

- Credit card balances

**Understanding Rapid Rescore**

With a rapid rescore, a lender pays a fee to credit reporting companies (Experian, TransUnion, or Equifax) to swiftly update recent account alterations on an applicant's credit report. Typically, after settling or clearing an account as directed by your lender, it might take one or two billing cycles for these payments to be processed and relayed to the credit bureaus. Only after these updates are reflected on your report will your credit scores show the adjustments.

Given the time-sensitive nature of loans, lenders might opt to pay a fee to get an applicant's payment details updated promptly. By providing evidence of recent payment activities, like clearing or reducing debts, to the credit reporting agency, the information can be updated faster, streamlining the approval process.

Once the credit report is refreshed, lenders can then request an updated credit score that mirrors these changes, potentially leading to a better score. Note that this service is exclusively available through your lender; individuals cannot initiate a rapid rescore independently.

Benefits of Rapid Rescore

-

Increase your credit score up to 100 points instantlly

- Resolve credit errors within 48 to 72 hours

- Correct errors on your credit report swiftly

-

Avoid waiting to update credit card balances

-

Potenitally obtain better loan rates

-

Only soft pull credit check, NO hard inquiries!

**Documentation is Key**

The success of a Rapid Rescore hinges on the evidence you provide. Ensure your documents are accurate and relevant. From transaction histories to creditor letters, every piece of evidence counts.

FAQs

Will it impact my credit score?

It will not affect your credit score or appear on credit reports viewed by lenders. Our system will only pull a soft inquiry so your credit will be preserved!

How much will it cost me to update an account on my credit report?

We charge $225 per tradeline. For example, if you're updating all 3 credit bureaus (TransUnion, Experian, Equifax) the cost will be $675.

How long does the Rapid Rescore process typically take?

The Rapid Rescore process is designed to be swift, with most credit errors or issues being disputed and potentially resolved within 24 to 72 hours.

What are unacceptable documents for a Rapid Rescore?

Payment receipts that do not reflect the new balance

Any document which does not have at least a partial account number

Documents older than 30 days old

Screen shots and/or documents in email form

Handwritten documents

Satisfactions/Lien Releases that are not recorded

Divorce Decrees

HUD Settlement Statements

Payment histories or transaction histories

What kind of documentation do I need to provide for a successful Rapid Rescore?

ALL documents, regardless of the type of document, must be dated within the past 30 days

Monthly statement (must include current balance & at least a partial account number)

Typed letter (on letterhead, dated and signed) from reporting creditor ONLY. (You cannot use a letter from the original creditor to update collection or vice versa.)

Internet statement (all internet statements must reflect at least a partial account number, the current balance and the internet “stamp” reflecting the URL and date)

Recorded lien satisfaction (must be recorded & stamped by the Court)

Official Bankruptcy papers (to update Public Records ONLY. Bankruptcy papers cannot be used to update individual tradelines that were included in a BK).

Is there a guarantee that my credit score will improve with Rapid Rescore?

We can guarantee we will process your request; however, it is up to the credit bureaus to decide the final outcome. Once we process the request, there will be no refunds.

It will not affect your credit score or appear on credit reports viewed by lenders. Our system will only pull a soft inquiry so your credit will be preserved!